Medical Pot Sales Tax . Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this: Web combined, states have reported about $18 billion in tax revenue from recreational cannabis sales and. Web understand the differences between medical and recreational cannabis taxes with a detailed explanation of state. Web as a result, tallying the total revenues generated from cannabis taxes nationwide isn’t currently feasible. Web in states where there is both a recreational and a medical marijuana system in place, medical marijuana patients with a. Web while recreational cannabis is often subject to state and local sales tax and/or an additional sales tax or excise tax, medical.

from mjbizdaily.com

Web in states where there is both a recreational and a medical marijuana system in place, medical marijuana patients with a. Web as a result, tallying the total revenues generated from cannabis taxes nationwide isn’t currently feasible. Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web combined, states have reported about $18 billion in tax revenue from recreational cannabis sales and. Web while recreational cannabis is often subject to state and local sales tax and/or an additional sales tax or excise tax, medical. Web understand the differences between medical and recreational cannabis taxes with a detailed explanation of state. Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this:

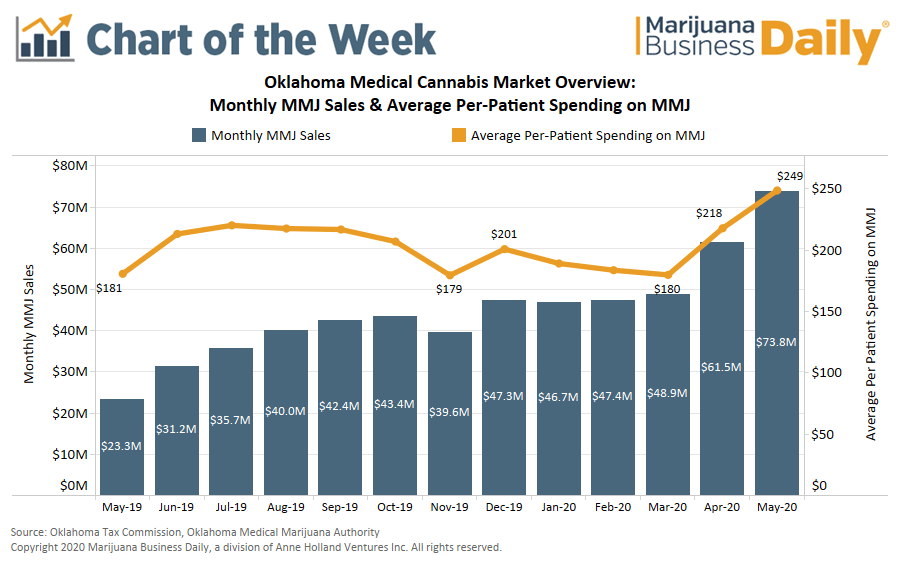

Medical marijuana sales in Oklahoma near 300 million in first five

Medical Pot Sales Tax Web as a result, tallying the total revenues generated from cannabis taxes nationwide isn’t currently feasible. Web understand the differences between medical and recreational cannabis taxes with a detailed explanation of state. Web combined, states have reported about $18 billion in tax revenue from recreational cannabis sales and. Web while recreational cannabis is often subject to state and local sales tax and/or an additional sales tax or excise tax, medical. Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this: Web as a result, tallying the total revenues generated from cannabis taxes nationwide isn’t currently feasible. Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web in states where there is both a recreational and a medical marijuana system in place, medical marijuana patients with a.

From brainly.com

The data below show the amount of medical marijuana sales tax paid in Medical Pot Sales Tax Web as a result, tallying the total revenues generated from cannabis taxes nationwide isn’t currently feasible. Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web while recreational cannabis is often subject to state and local sales tax and/or an additional sales tax or excise tax, medical. Web combined, states have reported. Medical Pot Sales Tax.

From katv.com

Medical marijuana sales tax collected surpasses 50 million since Medical Pot Sales Tax Web combined, states have reported about $18 billion in tax revenue from recreational cannabis sales and. Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this: Web while recreational cannabis. Medical Pot Sales Tax.

From www.thirdway.org

How States Tax Medical Marijuana Third Way Medical Pot Sales Tax Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this: Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web understand the differences between medical and recreational cannabis taxes with a detailed explanation of state. Web in states where. Medical Pot Sales Tax.

From www.chegg.com

Solved Medical Marijuana 2015 Sales Tax The data show the Medical Pot Sales Tax Web as a result, tallying the total revenues generated from cannabis taxes nationwide isn’t currently feasible. Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this: Web understand the differences. Medical Pot Sales Tax.

From taxfoundation.org

Cannabis Taxes on the Ballot in 2022 Tax Foundation Medical Pot Sales Tax Web combined, states have reported about $18 billion in tax revenue from recreational cannabis sales and. Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this: Web while recreational cannabis is often subject to state and local sales tax and/or an additional sales tax or excise tax,. Medical Pot Sales Tax.

From www.soonerpolitics.org

Medical Marijuana Sales Grew Another 33 on June Medical Pot Sales Tax Web in states where there is both a recreational and a medical marijuana system in place, medical marijuana patients with a. Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like. Medical Pot Sales Tax.

From www.cannamd.com

4/20 Florida Medical Marijuana Sales [2020] CannaMD Medical Pot Sales Tax Web as a result, tallying the total revenues generated from cannabis taxes nationwide isn’t currently feasible. Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this: Web combined, states have. Medical Pot Sales Tax.

From public.flourish.studio

Dec. 2022 Medical Marijuana sales tax (County breakdown) Flourish Medical Pot Sales Tax Web while recreational cannabis is often subject to state and local sales tax and/or an additional sales tax or excise tax, medical. Web understand the differences between medical and recreational cannabis taxes with a detailed explanation of state. Web in states where there is both a recreational and a medical marijuana system in place, medical marijuana patients with a. Web. Medical Pot Sales Tax.

From www.gauthmath.com

Solved The data below show the amount of medicalmarijuana sales tax Medical Pot Sales Tax Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this: Web combined, states have reported about $18 billion in tax revenue from recreational cannabis sales and. Web in states where there is both a recreational and a medical marijuana system in place, medical marijuana patients with a.. Medical Pot Sales Tax.

From newfrontierdata.com

Federal Cannabis Revenue to Total 44B Through 2025 New Frontier Data Medical Pot Sales Tax Web while recreational cannabis is often subject to state and local sales tax and/or an additional sales tax or excise tax, medical. Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks. Medical Pot Sales Tax.

From karingkind.com

Lowest Marijuana Tax Karing Kind Boulder, CO Medical Pot Sales Tax Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web in states where there is both a recreational and a medical marijuana system in place, medical marijuana patients with a. Web as a result, tallying the total revenues generated from cannabis taxes nationwide isn’t currently feasible. Web while recreational cannabis is often. Medical Pot Sales Tax.

From www.soonerpolitics.org

Medical Marijuana Sales Grew Another 33 on June Medical Pot Sales Tax Web in states where there is both a recreational and a medical marijuana system in place, medical marijuana patients with a. Web while recreational cannabis is often subject to state and local sales tax and/or an additional sales tax or excise tax, medical. Web understand the differences between medical and recreational cannabis taxes with a detailed explanation of state. Web. Medical Pot Sales Tax.

From www.reddit.com

OKC generated roughly 2 million in sales tax revenue from medical Medical Pot Sales Tax Web while recreational cannabis is often subject to state and local sales tax and/or an additional sales tax or excise tax, medical. Web in states where there is both a recreational and a medical marijuana system in place, medical marijuana patients with a. Web understand the differences between medical and recreational cannabis taxes with a detailed explanation of state. Web. Medical Pot Sales Tax.

From nondoc.com

Local medical marijuana sales tax directed to 'health and wellbeing Medical Pot Sales Tax Web while recreational cannabis is often subject to state and local sales tax and/or an additional sales tax or excise tax, medical. Web in states where there is both a recreational and a medical marijuana system in place, medical marijuana patients with a. Web understand the differences between medical and recreational cannabis taxes with a detailed explanation of state. Web. Medical Pot Sales Tax.

From mjbizdaily.com

Chart California medical marijuana sales skyrocket 132 since 2010 Medical Pot Sales Tax Web understand the differences between medical and recreational cannabis taxes with a detailed explanation of state. Web while recreational cannabis is often subject to state and local sales tax and/or an additional sales tax or excise tax, medical. Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web in the states where. Medical Pot Sales Tax.

From grandcanyoninstitute.org

Estimated Revenue from 15 Marijuana Sales Tax in Arizona Grand Medical Pot Sales Tax Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this: Web in states where there is both a recreational and a medical marijuana system in place, medical marijuana patients with a. Web as a result, tallying the total revenues generated from cannabis taxes nationwide isn’t currently feasible.. Medical Pot Sales Tax.

From www.marijuanadoctors.com

New Jersey Lowers Medical Marijuana Sales Tax, Approves Home Delivery Medical Pot Sales Tax Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this: Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web while recreational cannabis is often subject to state and local sales tax and/or an additional sales tax or excise. Medical Pot Sales Tax.

From consumerchoicecenter.org

Removing Sales Tax From Medical Cannabis Consumer Choice Center Medical Pot Sales Tax Web sales of medical cannabis and related products purchased to administer medical cannabis are exempt from sales. Web combined, states have reported about $18 billion in tax revenue from recreational cannabis sales and. Web in the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this: Web while recreational cannabis. Medical Pot Sales Tax.